Hurricane Season and Auto Insurance: Are You Covered?

Every year, from June through November, hurricane season brings strong winds, heavy rain, and the threat of flooding across many parts of the U.S.—especially in coastal states like Florida, Louisiana, and Texas. While most people think about boarding up windows or stocking up on bottled water, there's another important area you shouldn't overlook: your auto insurance.

If a hurricane damages your car, will your current policy cover it? The answer depends on what kind of coverage you have—and what steps you've taken ahead of time. Here's what every driver should know before the next big storm rolls in.

What Types of Hurricane Damage Can Affect Your Car?

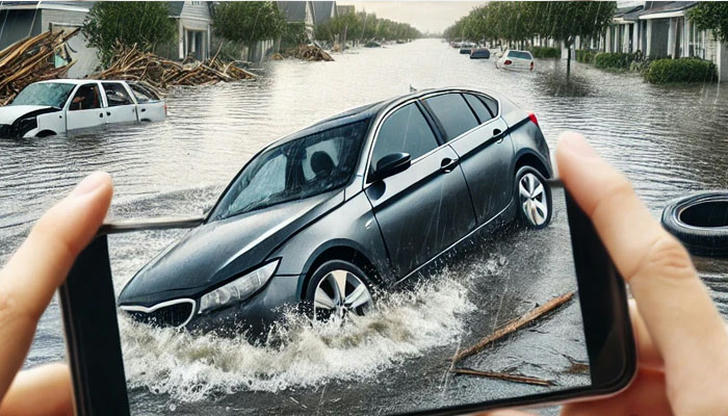

Hurricanes bring more than just strong winds. You could face fallen trees, flying debris, flash floods, or even your garage roof collapsing on your vehicle. All of these can cause serious—and expensive—damage.

Common types of hurricane-related damage include:

• Flooded interiors or engines

• Broken windows or dents from debris

• Wind-damaged paint or body panels

• Complete vehicle loss due to flooding or collapse

The big question is—does your insurance cover those?

Liability Insurance Alone Isn't Enough Many drivers only carry the minimum required liability insurance. While this meets state requirements, liability insurance only covers damage you cause to other people or property—not damage to your own car.

So if a tree crashes down on your hood or floodwaters destroy your engine, you'll be on the hook for those repairs yourself unless you have additional coverage.

You Need Comprehensive Coverage for Storm Protection

The type of insurance that protects your car from natural disasters—like hurricanes—is called comprehensive coverage.

Comprehensive covers non-collision events such as:

• Flooding

• Fire

• Falling objects

• Vandalism

• Storm damage

If you live in a hurricane-prone area, comprehensive coverage is not optional—it's essential. It can make the difference between replacing your car and paying thousands out-of-pocket.

Don't Wait—Some Policies Have Waiting Periods

Thinking of adding comprehensive coverage now that hurricane season has started? Smart move—but don't wait too long. Some insurers may not allow you to change or add coverage if a storm is already approaching your area.

Others may have waiting periods, meaning the coverage won't take effect immediately. To stay safe, review your policy before hurricane season begins—or right now if you haven't yet.

What About Flood Damage?

You might assume flood damage is automatically covered. It's not—unless you have comprehensive coverage. Flooding is one of the most common and costly effects of hurricanes, and standard auto insurance won't cover it.

If your car is parked in a driveway or garage and a storm surge floods it, your insurer will only help if you've chosen comprehensive.

Pro tip: If you lease or finance your car, comprehensive is usually required by your lender. But if you own your car outright, you may have dropped it—so check your policy.

File Your Claim Quickly and Take Photos

If your car is damaged during a hurricane, you'll need to act fast. Here's what to do:

• Take clear photos of all visible damage from multiple angles.

• Avoid driving the car if it's flooded or has electrical issues.

• Contact your insurance company as soon as it's safe to do so.

• Save any receipts if you need to tow or move the vehicle.

Insurers may be handling a high volume of claims after a major storm, so the sooner you file, the better.

Will a Hurricane Claim Raise My Rates?

It's possible—but not guaranteed. Since hurricane damage is usually classified as a “comprehensive” claim and not your fault, it's less likely to impact your rates the same way an at-fault accident would.

That said, if your area is frequently hit by storms and claims are common, insurers might raise premiums across the board. That's another reason to shop around every year and make sure you're getting the best deal for your coverage needs.

How to Prepare Before the Storm Hits

Insurance is just part of hurricane preparation. To help minimize damage and protect your vehicle:

• Park on higher ground or in a covered garage.

• Avoid street parking if possible—these spots are more flood-prone.

• Unplug chargers and electronics in the car if flooding is likely.

• Keep a copy of your insurance and registration in a waterproof bag.

Preparedness can reduce your risk—and make the claims process smoother if the worst happens.

Final Thoughts: Review Now, Not Later

Hurricane season can be unpredictable, but your insurance coverage shouldn't be. Take time to review your auto policy now. If you don't have comprehensive coverage and you live in an area that sees storms, it's time to consider upgrading.

It might only cost a few extra dollars a month—but it could save you thousands when the next hurricane hits. Don't wait until the wind is howling and the rain is pouring to wonder, “Am I covered?” Take action today, and drive into storm season with peace of mind.